As we welcome the new year, Florida homeowners are facing a growing challenge: the state’s struggling home insurance market. With rising premiums and stricter coverage requirements, securing affordable insurance has become a priority for many. A 4-point home inspection can be your key to navigating this tough landscape while saving money and ensuring your home is properly protected.

At Vcita Home Inspection, we specialize in helping homeowners meet insurance requirements, uncover potential savings, and protect their homes. Let’s dive into the most common questions about 4-point inspections and how they can benefit you.

What Is a 4-Point Home Inspection?

Question: What does a 4-point inspection cover, and why is it important?

Answer:

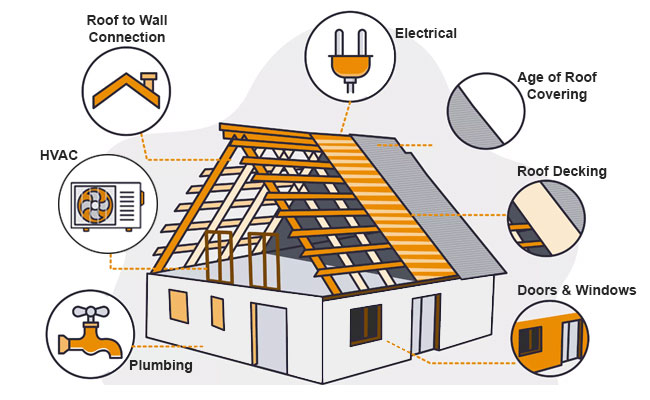

A 4-point home inspection focuses on four critical systems in your home:

- Roofing: Evaluates the roof’s age, condition, and potential vulnerabilities.

- Electrical Systems: Checks for safety hazards, outdated wiring, or panels.

- Plumbing Systems: Identifies leaks, material types, and potential failures.

- HVAC (Heating, Ventilation, and Air Conditioning): Ensures systems are functional and safe.

Why it matters:

- Insurance Requirements: Many insurance companies require 4-point inspections, especially for homes over 20 years old, to ensure the property meets safety and risk standards.

- Identify Issues Early: Uncovering problems now allows you to address them before they escalate, saving time and money.

How Can a 4-Point Inspection Save You Money?

Question: Can a 4-point inspection lower my insurance premiums?

Answer:

Yes! By demonstrating that your home’s systems are up to code and in good condition, you may qualify for lower insurance premiums. Insurance providers view well-maintained homes as lower risk, which often translates to better rates.

Additional ways it saves money:

- Prevents denied claims due to pre-existing conditions.

- Avoids costly repairs by catching problems early.

- Ensures eligibility for the most affordable insurance policies.

Why Is the Florida Home Insurance Market Struggling?

Question: Why are Florida insurance premiums so high?

Answer:

Florida’s home insurance market faces unique challenges due to frequent hurricanes, storm-related claims, and increased litigation. As a result:

- Premiums Are Rising: Florida homeowners pay three times the national average for insurance.

- Insurers Are Leaving: Many companies are exiting the state or reducing coverage offerings.

- Stricter Requirements: Insurers are requiring detailed inspections to minimize risks.

A 4-point inspection can help you secure coverage in this challenging market and potentially lower your premiums.

Why Should You Get a 4-Point Inspection Before Spring?

Question: Why is now the right time to schedule a 4-point inspection?

Answer:

Florida’s spring season often brings heavy rains and storms that can expose hidden vulnerabilities in your home’s systems. By scheduling an inspection now, you can:

- Address Issues Early: Fix problems like roof leaks or outdated wiring before the rainy season.

- Prepare for Insurance Renewals: Ensure your home meets insurance requirements to avoid coverage lapses.

- Start the Year Confident: Enter the new year knowing your home is safe and protected.

What Sets Vcita Home Inspection Apart?

Question: Why choose Vcita Home Inspection for your 4-point inspection?

Answer:

At Vcita Home Inspection, we offer:

- Certified Expertise: Our licensed inspectors provide detailed, accurate assessments.

- Insurance Knowledge: We understand Florida’s insurance requirements and help you navigate them with ease.

- Comprehensive Reports: Our clear, easy-to-read reports ensure you have everything your insurer needs.

- Ongoing Support: With our Free Insurance Report Evaluation, we help you save money and optimize your coverage long after the inspection.

How Can Vcita’s Free Insurance Report Evaluation Save You Money?

Question: What is an insurance report evaluation, and how does it help?

Answer:

Our Free Insurance Report Evaluation is designed to uncover savings and optimize your insurance policy.

Here’s how it works:

- Upload Your Policy: Visit Vcita’s Free Insurance Evaluation to submit your insurance documents.

- Get Expert Feedback: We review your policy to identify gaps, opportunities for savings, and compliance issues.

- Receive Recommendations: From updating inspection reports to suggesting alternative providers, we guide you toward cost-effective solutions.

- Save Money: Our evaluation helps you reduce premiums and secure better coverage without sacrificing protection.

What Are the Risks of Skipping a 4-Point Inspection?

Question: What happens if I don’t get a 4-point inspection?

Answer:

Without a 4-point inspection, you may face:

- Higher Premiums: Missing out on inspection-based discounts could cost you hundreds annually.

- Denied Coverage: Insurers may refuse coverage for homes with outdated systems.

- Costly Repairs: Undetected issues could lead to significant expenses later.

Ring in the New Year with Peace of Mind

The new year is the perfect time to ensure your home is safe, secure, and ready for whatever comes next. A 4-point home inspection from Vcita Home Inspection helps you navigate Florida’s challenging insurance market, uncover savings, and protect your biggest investment.

📞 Contact us today to schedule your inspection and take advantage of our Free Insurance Report Evaluation. From all of us at Vcita Home Inspection, Happy New Year!

About Vcita Home Inspection

Vcita Home Inspection, led by Calvin Johnson, is Port St. Lucie’s trusted provider for certified home and 4-point inspections. We’re dedicated to helping Florida homeowners safeguard their properties and reduce their insurance costs with expert support and guidance.

#4PointInspection #FloridaHomeInsurance #VcitaHomeInspection #InsuranceSavings #PortStLucie #HappyNewYear #HomeSafety

Phone

(844) 332-2264 (Head Office)

(772) 224-5655 (Direct Line)

(954) 295-5216 (Direct Line)

E-mail

calvinjohnson772@gmail.com

calvin@vcitahomeinspection.com

support@vcitahomeinspection.com

Proudly Serving:

Port St. Lucie | Fort Pierce | Stuart | Jupiter